Help to Buy: ISA

How does it work?

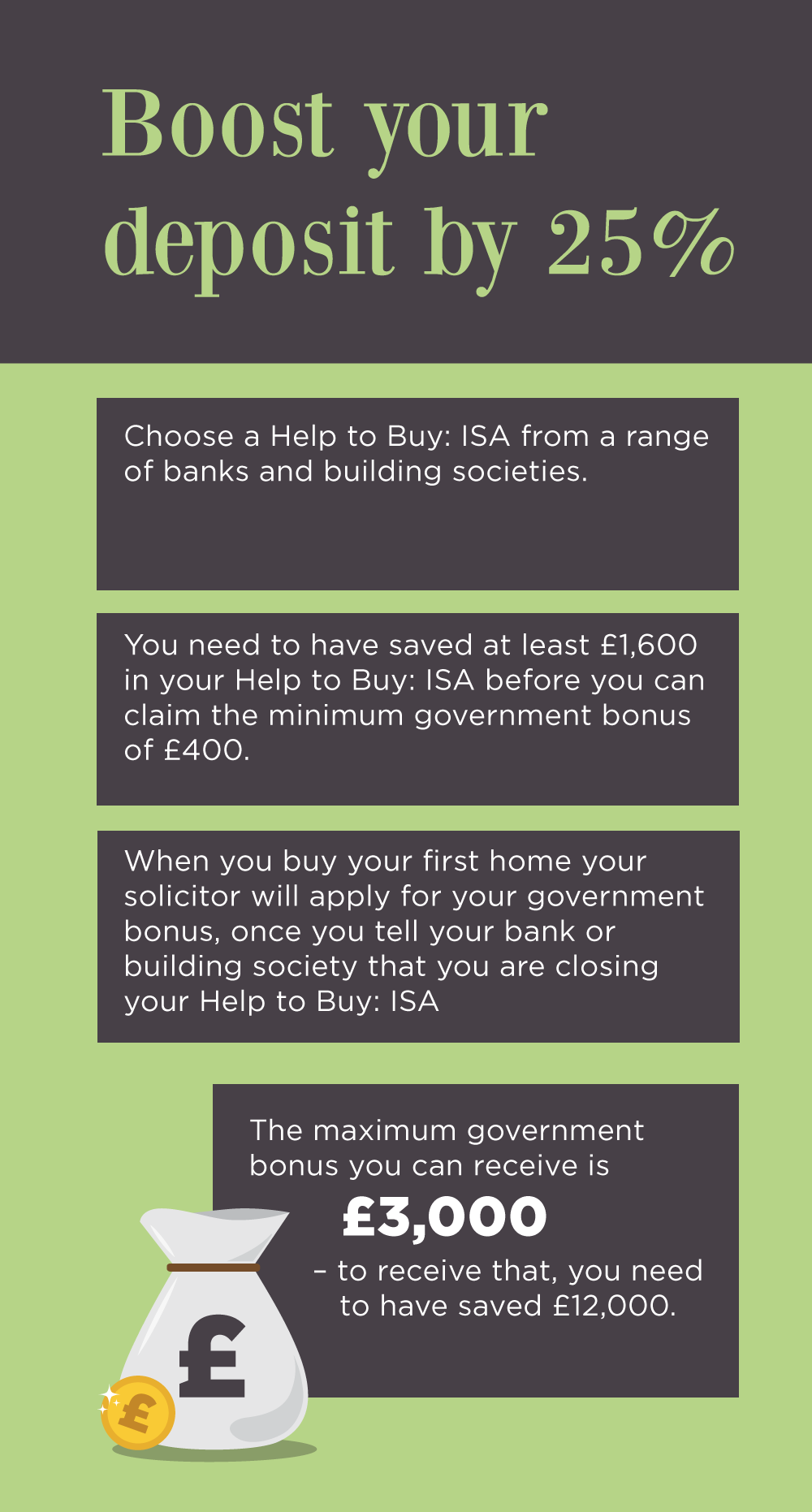

If you are saving to buy your first home, save money into a Help to Buy: ISA and the Government will boost your savings by 25%, meaning for every £200 you save, you will receive a government bonus of £50. The maximum government bonus you can receive is £3,000.

Open: the Help to Buy: ISA is available from a range of banks, building societies and credit unions.

The accounts are available to each first time buyer, not each household. This means that if you are planning to buy with your partner, for example, you could receive a government bonus of up to £6,000 towards your first home.

Save: save up to £200 a month into your Help to Buy: ISA. To kickstart your account, in your first month, you can deposit a lump sum of up to £1,200.

The minimum government bonus is £400, meaning that you need to have saved at least £1,600 into your Help to Buy: ISA before you can claim your bonus. The maximum government bonus you can receive is £3,000 – to receive that, you need to have saved £12,000.

Receive bonus: when you are close to buying your first home, you will need to instruct your solicitor or conveyancer to apply for your government bonus. Once they receive the government bonus, it will be added to the money you are putting towards your first home. The bonus must be included with the funds consolidated at the completion of the property transaction. The bonus cannot be used for the deposit due at the exchange of contracts, to pay for solicitor’s, estate agent’s fees or any other indirect costs associated with buying a home.

Find out if you’re eligible for a Help to Buy: ISA here.